This sordid septic soul can see / You’re under control uncontrollably

08/02/16

As we recently published in OCL, on 16 October 2015 the Spanish Markets and Competition Commission (CNMC) fined pharmaceuticals manufacturer Grifols SA €106,500 for going ahead with the acquisition of certain assets from Novartis International AG without seeking prior CNMC clearance (see the CNMC decision on SNC/DC/037/15). Grifols SA notified the concentration only after implementing the deal, once the CNMC, alerted by media coverage, had expressly required Grifols SA to file (see the CNMC concentration file on C/0607/14).

It was not obvious that this acquisition required regulatory clearance. In Spain, notification thresholds relate not only to turnover but also to market share. If there is an overlap and the merged entity’s market share is 30% or more, the concentration will need prior clearance unless the target’s turnover in Spain is up to €10 million. So does any concentration between parties whose joint market shares are 50% or more, even if turnover is negligible.

Grifols SA had checked before going ahead and concluded that it needed not notify, since the target’s turnover was, according to its own data, below €10 million and the parties’ joint market share was 49%. The CNMC dismissed this figure and calculated a joint market share of 52.2%.

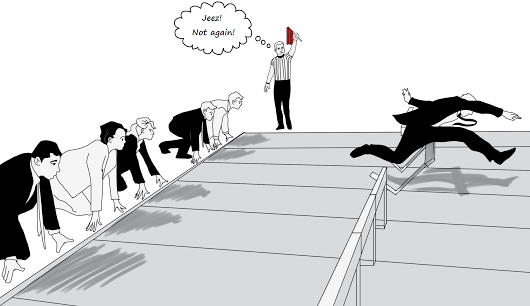

In its decision, the CNMC stated that: (i) Grifols SA had been negligent; and (ii) while admittedly market shares may not always be clear, when in doubt the parties should consult the CNMC prior to implementing their concentration (Article 55(2) of the Spanish Competition Act expressly offers this possibility).

This case reveals the CNMC’s rather strict views on the obligation to notify. What is interesting, however, is how the CNMC discusses negligence, which it did take into account when setting the amount of the fine. There is no direct hint that Grifols SA’s made its first calculation lightly. The facts from which the CNMC infers negligence are that Grifols SA (i) submitted two further calculations during the administrative proceedings before the CNMC, both different from the first one; and (ii) finally filed a belated notification based on a fourth calculation of market shares above 50%.

Looked at from the angle of legal certainty, it is striking that the CNMC should infer from Grifols SA’s behavior after the CNMC challenged its original calculation that the latter was not diligent to the requisite standard and indeed that Grifols SA should have doubted such own calculation. Also, it would not seem to go without saying that a company which has doubts as to a mere question of fact, such as market shares, must put such doubts to the CNMC pursuant to Article 55(2) of the Spanish Competition Act or, should it not take this avenue, be considered negligence. This seems quite different from the Commission’s pioneering stance in Case IV/M.920 Samsung/AST, namely that “a multinational company with very extensive activities in Europe […] cannot be unaware of the need to respect European merger control rules” (at point 12). Again, Grifols SA’s did check the legal threshold before going ahead – its only motive for doubting its own calculation at the time would have been that… the result was very close to such threshold.

Interestingly, another picky decision by the CNMC’s predecessor, the National Competition Commission (CNC), on gun jumping was recently overturned by the Spanish Court of Appeals. The issue here was whether granting the acquirer veto rights over the annual accounts and new financial debt is tantamount to implementing a concentration. Unlike the CNC, the Court found that it is not (see the details of the CNC file and its judicial review at VSNC/0015/11). The Court’s judgment is in line with EU case-law on this subject.